Post-Pandemic Economic Recovery: What Does it Mean for the Future of the Global Theme Park Industry?

As the world’s nations continue to navigate the COVID-19 pandemic, the global theme park industry exemplifies many of the challenges still faced – as well as the creative, future-focused solutions being implemented. Below, we’ll explore the global economic recovery, how theme park development and attendance continue to be impacted by the pandemic, and where industry […]

As the world’s nations continue to navigate the COVID-19 pandemic, the global theme park industry exemplifies many of the challenges still faced – as well as the creative, future-focused solutions being implemented.

Below, we’ll explore the global economic recovery, how theme park development and attendance continue to be impacted by the pandemic, and where industry stakeholders can seize opportunities for growth at this critical time of industry evolution.

An Uneven Recovery

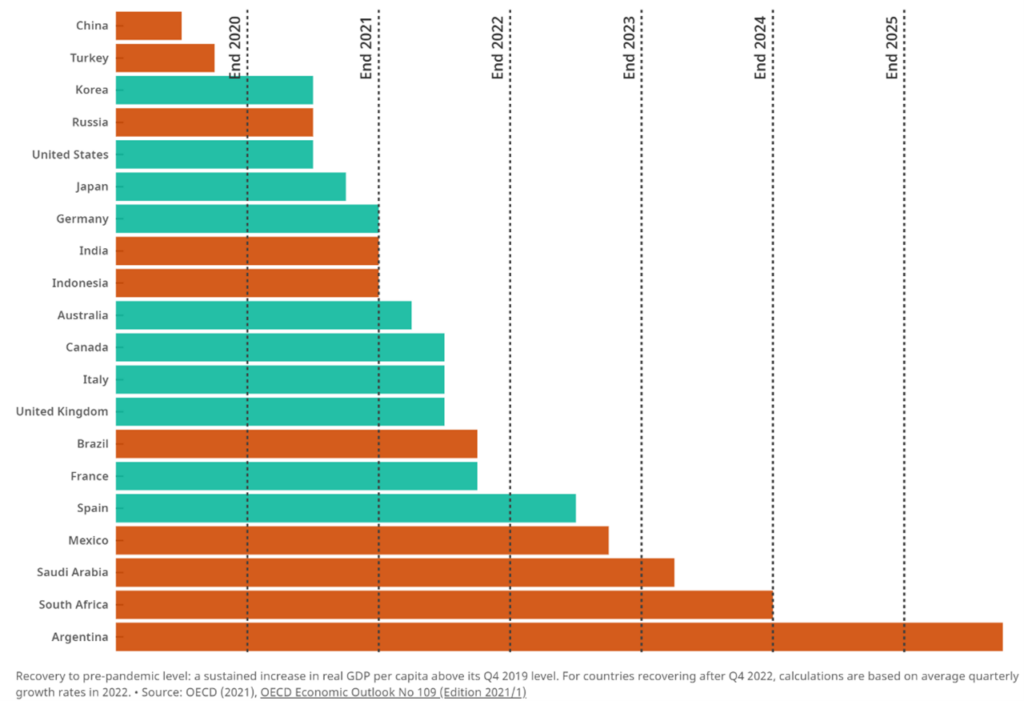

While bright signs of economic recovery indicate hope for a swift return to pre-pandemic levels, it is important to remember that this is no ordinary recovery – as its pace has been vastly uneven across locations and industries.

The global economic landscape is a dizzying blend of quickly rising peaks and slowly sinking valleys, because economic recovery depends heavily on the effective distribution of vaccines and the ability of local public health agencies to control the further spread of COVID-19.

For example, recovery to pre-pandemic GDP was reached by some countries months ago, while for others it could be several years away.

Supply Chain Disruptions

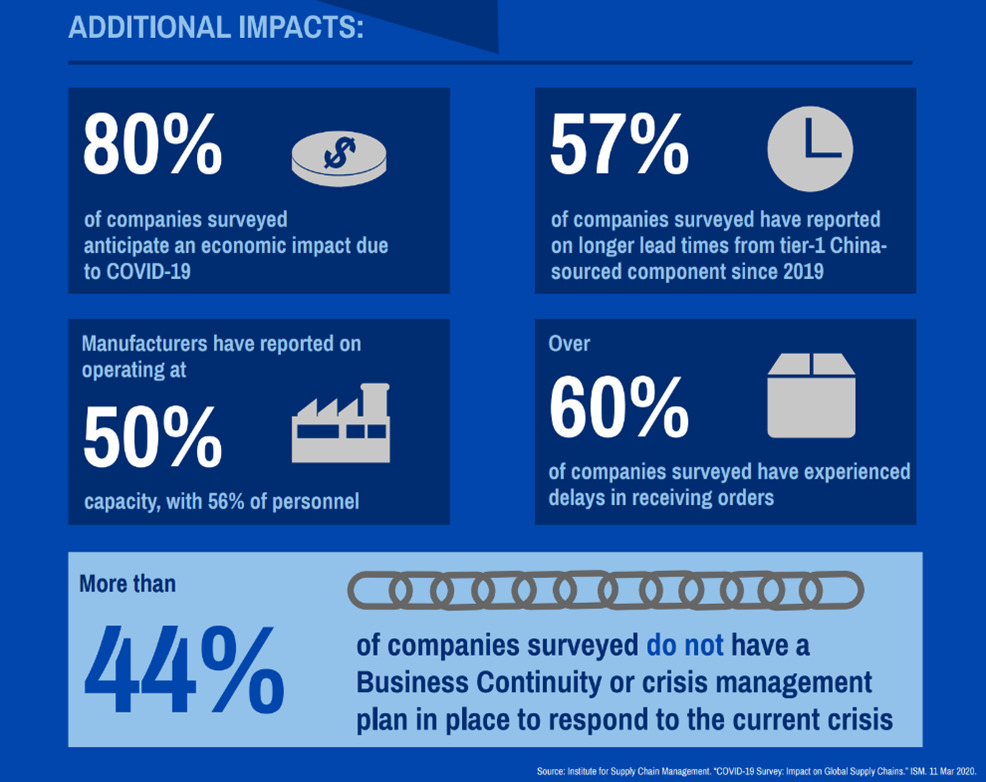

This mismatch of economic productivity has placed significant strain on the global supply chain. Our global interdependence has insured that this is felt to some degree by the majority of businesses around the world, with development across sectors – including the theme park industry, which entails many more complexities than traditional development – particularly hard hit.

Development throughout the world continues to face the challenges of increased material and component costs, as well as additional costs due to significant schedule delays – on top of navigating public health and corporate guidelines to provide safe and productive work environments.

Through the initial stages of the pandemic, lockdowns in most countries created a pent-up demand for goods. However, decreases in productivity due to COVID-19 restrictions has led to a sustained shortage of raw materials.

As lockdowns have lifted in certain countries and large-scale private projects restart, supply has been unable to keep up with demand. Manufacturers are still not accepting orders for certain components, while others list a delay of up to six months, greatly impacting project lead times.

Continued Uncertainty Over Long-Term Impacts

The pandemic and its impacts on national economies and industries on a global scale are still unfolding in unpredictable ways.

For instance, the United States – despite effective vaccine distribution and rapid economic recovery plans – faces a unique combination of challenges. Lockdowns led to widespread furloughs and layoffs, necessitating a robust federal unemployment benefit response.

Now, as companies push for re-opening, they are struggling to reattract labor. The pandemic has placed a spotlight on workers’ demands including increasing decades-long stagnant wages, improving working conditions, and providing a work-life balance. Some companies have begun to adjust to these worker demands; however, a wide-spread labor shortage continues to aggravate productivity and increase consumer costs in both large corporations and small companies.

Additionally, economic stimulus programs have spurred consumer spending. This increased spending, combined with shortages in goods and labor likely caused a spike in inflation. Even when excluding food and energy components, inflation rose 4.3% year-over-year for the month of July [2021].

As of now, this surge in consumer prices, which the Federal Government views as temporary, seems to be unique to the United States – at least in comparison with the world’s largest economies.

That said, it remains a question if other regions such as Europe – which recently surpassed the U.S. in vaccinations – will follow a similar trajectory of inflating costs.

The Global Theme Park Industry is Slowly – but Surely – Recovering

The COVID-19 pandemic devastated theme park attendance in 2020 as governments around the world enacted strict lockdowns on travel and in-person gatherings. When parks, museums, and attractions were finally allowed to reopen, they were required to do so at a limited capacity.

Due to this, the theme park market has declined by approximately $2 billion USD over the course of the pandemic.

Initial predictions taken at the end of 2020 evaluated promising vaccine success and anticipated a rapid return to pre-pandemic levels. A study from December 2020 predicted a rebound and growth of 23%.

In reality, inconsistent vaccine distribution, the onset of the Delta variant, and fragility in the global supply chain throughout much of 2021 has tempered such economic predictions. Recent studies from June 2021 predict a more modest growth of 9% across the global theme park industry.

How Can Theme Parks Position Themselves for Success Going Forward?

To achieve this growth in the face of reduced capacity requirements, the global theme park industry aims to move towards the future ‘Post-COVID-19 Theme Park.’

One significant shift is that the mass-market approach of Mega Theme Parks from prior to the pandemic is pivoting.

For example, Mega Theme Parks are moving to a more exclusive pricing model with the goal of maintaining similar profit margins at reduced capacity. Smaller regional parks will likely adopt these dynamic pricing models, like the ones Disney has proven to be successful since 2018.

The pandemic may have sped the transition to this Theme Park of the Future, but the trends go beyond public health and have been visible for years.

In addition to the sanitary benefits of touchless ticketing and guest services, widespread use of technology provides productivity efficiencies. At the cost of technological infrastructure investments, touchless ticketing and point-of-sale can reduce wait times, optimize food and beverage services, and promote retail to ultimately increase revenue.

To target the Millennial and Gen Z markets, theme parks developers and operators have also invested in premium paid experiences and focused on environmental and social issues, and have already begun investing more capital into experiential dining, retail, and accommodations – such as Disney’s ambitious Galactic Starcruiser Hotel.

Theme Parks are similarly investing in LEED certifications, clean energy, and expanded vegan menu offerings, demonstrating the importance of corporate sustainability and environmentally conscious guest offerings.

In the midst of a prolonged recovery of the global theme park industry, lingering economic uncertainty, and a critical need to capture the interest of today’s target guests, successful global theme park industry stakeholders will be those who are able to execute and adapt to future-focused development and operations on scales that are feasible for them in the current climate.